In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day.

In the latest version of the app we are introducing:

- Blik Pay Later - this new payment method will allow you to pay for products even within 30 days from your purchase.

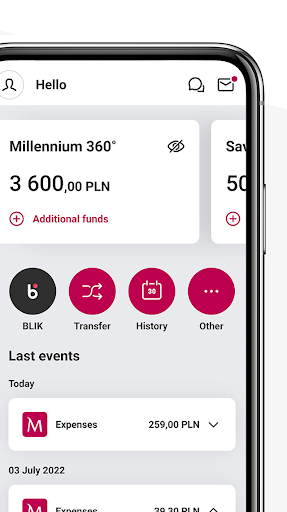

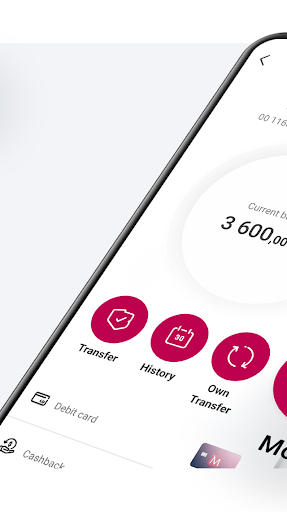

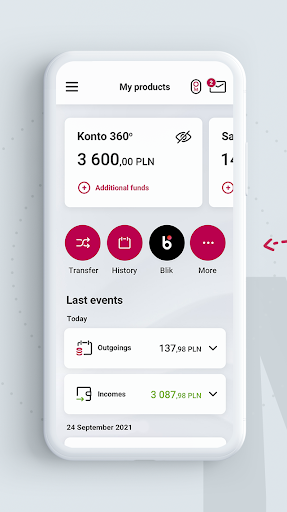

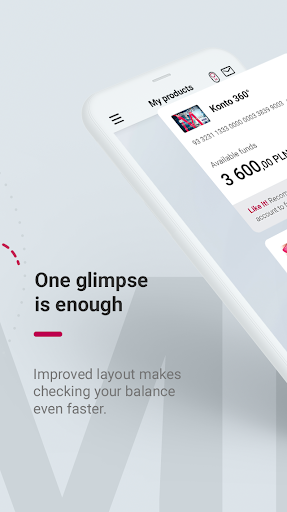

- Refreshed app - it will be more convenient and clearer, but still just as simple!

- Documents in the app - this section allows you to find your agreements, annexes and letters regarding your products at the bank.

In the latest version of the app, you will find a new section Documents and agreement, where you can find all your agreement, annexes, letters, and other documents regarding your products in our bank. Until now, they were available only in online banking.

In the latest version of the app, you will find a new section Documents and agreement, where you can find all your agreement, annexes, letters, and other documents regarding your products in our bank. Until now, they were available only in online banking.

In the latest version of the app, you will find a new section Documents and agreement, where you can find all your agreement, annexes, letters, and other documents regarding your products in our bank. Until now, they were available only in online banking.

In the latest version of the app, you will find a new section Documents and agreement, where you can find all your agreement, annexes, letters, and other documents regarding your products in our bank. Until now, they were available only in online banking.

In the latest version of the app, you will find a new section Documents and agreement, where you can find all your agreement, annexes, letters, and other documents regarding your products in our bank. Until now, they were available only in online banking.

This mobile app version includes numerous bug fixes and improvements to make your whole experience even more enjoyable.

In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day.

In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day.

In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day.

In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day.

In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day.

In the latest version of the mobile app you will find:

- a new edition of the "Like it? Share it" programme.

- fixes and improvements

We have disabled access to the app for systems lower than Android 6.

In the latest version of the app, you will find:

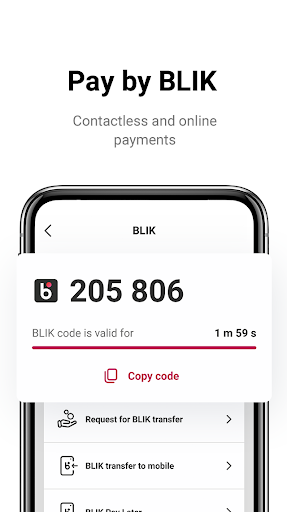

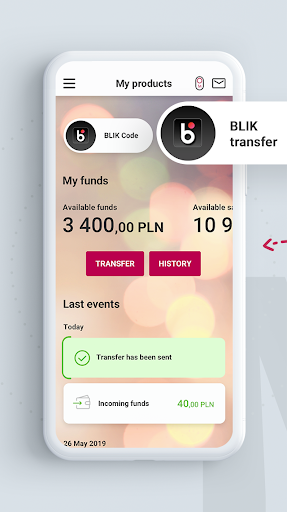

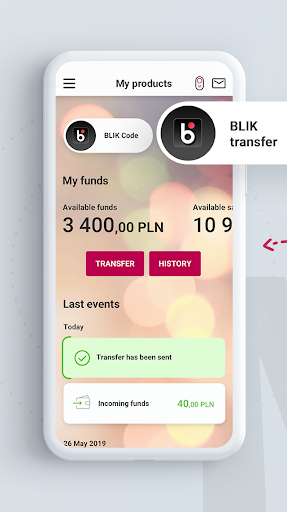

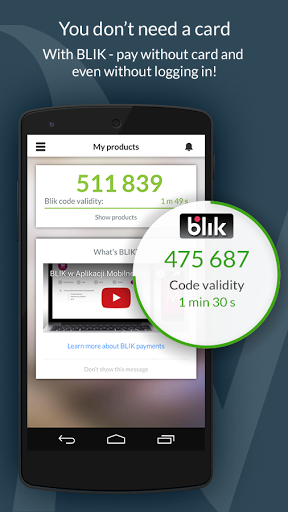

- BLIK Transfer Request - now you can easily split the joint bill at a restaurant.

- Before-login shortcut to cashback service and list of transactions with cashback

In the latest version of the app, you will find:

Main limit of online transactions settings

BLIK contactless payments in the app for children 7-12 years old

In the latest version of the app, you will find:

Main limit of online transactions settings

BLIK contactless payments in the app for children 7-12 years old

In the latest version of the app, you will find:

BLIK Transfer Request - now you can send your friends a transfer request and for example easily settle a joint bill at a restaurant.

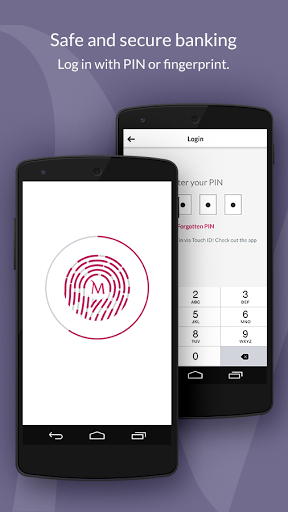

Payments authorisation with a fingerprint, face scan or PIN.

In the latest version of the app, you will find:

• A direct connection to an expert for business customers - with this connection we do not require additional verification, logging into the app is sufficient. This solution could already be used by individual customers.

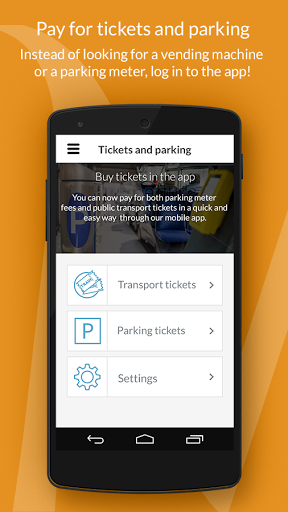

• Easier ticket purchase - we made some changes that will allow you to find the location where you want to buy a public transport ticket or pay for parking even more convenient. Check out the Additional Services tab.

In the latest version of the app, you will find:

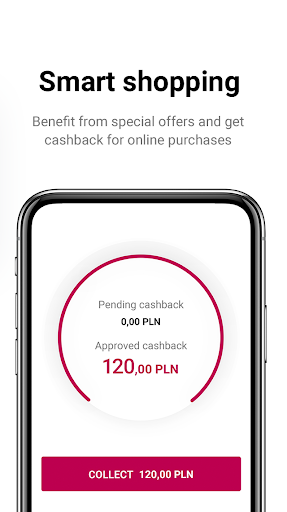

• Smart shopping tool - see how much you can gain if you start using our cashback program. Take a look at the Additional services > Cashback tab.

• New tools for saving - check what we have prepared in My Finances > Savings and Investments tab.

In the latest version of the app, you will find fixes and improvements that may not be apparent to you at first glance, but they will make using the app easier every day

In the latest version of the app:

• we improved the Currency Package for credit cards,

• it's easier to set up or change a standing order for your investment,

• if you open a structured deposit at our branch, you can confirm it in the mobile app.

In the latest version of the app:

• we improved the Currency Package for credit cards,

• it's easier to set up or change a standing order for your investment,

• if you open a structured deposit at our branch, you can confirm it in the mobile app.

In the latest version of the app, you will find:

·Applications for "Dobry Start 300+" benefit in the tab MilleAdministration - applications available for all eligible persons with the PESEL number assigned

·Currency package for credit cards - unlimited card transactions in any currency without a bank exchange margin

·Top-up codes for online services and multimedia in the app version for children aged 7-12

·New term deposit in the section Offer for you

In the latest version of the app, you will find features of our new Millennium 360° account offer:

• Cashback programme - the cashback for online shopping in almost 800 stores, it's easily manageable in the app.

• Currency package - in the app, you can turn on and off the package of unlimited currency transactions for the new Millennium 360° debit card.

• Process of opening the new Millennium 360° account for bank clients.

This mobile app version includes numerous bug fixes and improvements to make your whole experience even more enjoyable.

This mobile app version includes numerous bug fixes and improvements to make your whole experience even more enjoyable.

This mobile app version includes numerous bug fixes and improvements to make your whole experience even more enjoyable.

In the new app version:

- divide into instalments every transaction made with a credit card for transactions over 300 PLN, including transactions that have not yet been booked or settled

- select also the credit card account as the source account for transfers and make a transfer from the credit card to another bank

- use new, more flexible settings for credit card limits (up to the daily card limit).

This version also includes bug fixes and minor improvements.

In the new app version:

• you will reach features from the Transport tab faster because they will be now visible directly in the Additional services section

• you can now add a vehicle registered in another European country (we added 15 countries) to the Motorways service

• we changed the name of goodie cashback to Promotions and cashback

This version also includes bug fixes and minor improvements.

In the new app version:

• you can buy a new investment plan even more conveniently

• you will quickly check your MilleKod in the section Settings > Personal details > Your MilleKod

This version also includes bug fixes and minor improvements.

In the latest version of the app, you can now:

-conveniently and quickly add a trusted recipient from the level of the transfer form

-we have also changed part of the app activation and Mobile Authorization process

The version also includes minor fixes and improvements.

In the latest version of the app, you can now:

- fill in the investment survey to get to know your knowledge and experience in the area of investments

- browse our investment offer

- purchase selected savings and investment products

The version also includes minor fixes and improvements.

In the latest version of the app, you can now:

- fill in the investment survey to get to know your knowledge and experience in the area of investments

- browse our investment offer

- purchase selected savings and investment products

The version also includes minor fixes and improvements.

This mobile app version includes numerous bug fixes and improvements to make your whole experience even more enjoyable.

In this version of the mobile app you will find:

• option to custom daily limit of online transactions by card

• shortcut before login to call a helpline consultant directly from the app

The version also includes minor fixes and improvements

In this version of the mobile app you will find:

• viewing and setting transaction, BLIK and card limits in one place: Settings> Payment settings> Transaction, BLIK and card limits

• the option of confirming card online payments active from the moment of activation of the application

• the option to set biometric logon when activating the application

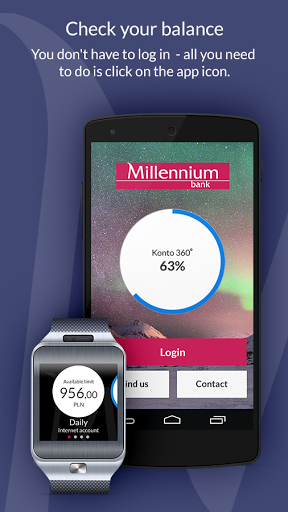

• new option to set up the account balance widget directly from the screen before logging in

The version also includes minor fixes and improvements

In this version of the mobile app you will find:

- revamped login screens with no process changes

- convenient access to BLIK transfers to mobile without the need to log in

In this version of the mobile app you will find:

- revamped login screens with no process changes

- convenient access to BLIK transfers to mobile without the need to log in

- a wider range of help topics within our Milla chatbot

The version also includes minor fixes and improvements.

In this version of the mobile app you will find:

- revamped login screens with no process changes

- convenient access to BLIK transfers to mobile without the need to log in

- a wider range of help topics within our Milla chatbot

The version also includes minor fixes and improvements.

This version includes minor bug fixes and improvements.

In the new version of the mobile app in the Additional services tab, you will now find a direct link to goodie. After logging in or short registration (if you are not using goodie yet) you can:

- go to online stores

- shop in over 800 stores

- receive cashback for your online purchases

- take advantage of numerous promotions

The version also includes minor fixes and improvements.

In the new version of the mobile app in the Additional services tab, you will now find a direct link to goodie. After logging in or short registration (if you are not using goodie yet) you can:

- go to online stores

- shop in over 800 stores

- receive cashback for your online purchases

- take advantage of numerous promotions

The version also includes minor fixes and improvements.

In the new version of the mobile app in the Additional services tab, you will now find a direct link to goodie. After logging in or short registration (if you are not using goodie yet) you can:

- go to online stores

- shop in over 800 stores

- receive cashback for your online purchases

- take advantage of numerous promotions

The version also includes minor fixes and improvements.

In the new version of the mobile app in the Additional services tab, you will now find a direct link to goodie. After logging in or short registration (if you are not using goodie yet) you can:

- go to online stores

- shop in over 800 stores

- receive cashback for your online purchases

- take advantage of numerous promotions

The version also includes minor fixes and improvements.

In the new version of the app you can benefit from higher daily transaction limits. Update your settings and adjust limits to your needs conveniently in the app.

This version also includes minor fixes and improvements.

In the new version of the app you can benefit from higher daily transaction limits. Update your settings and adjust limits to your needs conveniently in the app.

This version also includes minor fixes and improvements.

This version includes minor bug fixes and improvements.

This version includes minor bug fixes and improvements.

In the new version of the app:

- you will update your documents easier and faster thanks to notifications and a simplified form

This version also includes minor bug fixes and improvements.

At the seaside and in the mountains – the new app version will pass the test wherever you take it! You can now change transaction limits in the mobile app and thanks to several improvements and bug fixes, app performance is even more reliable.

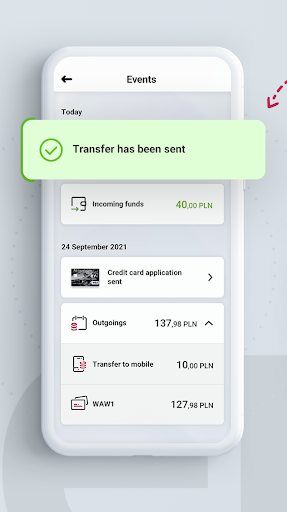

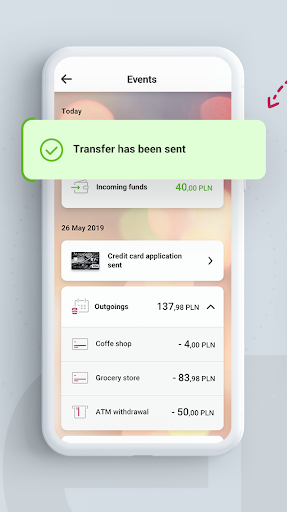

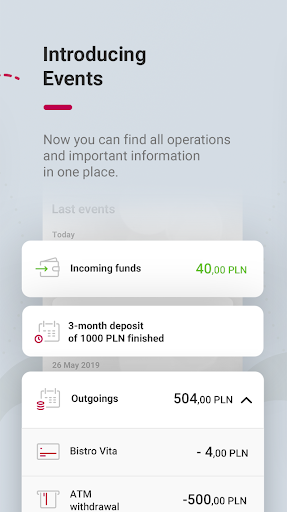

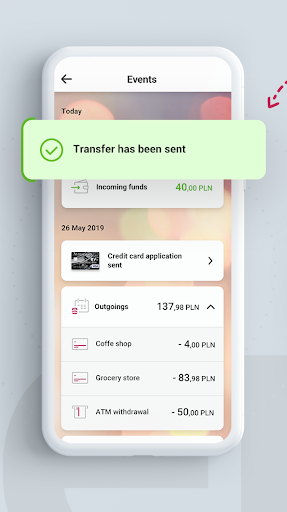

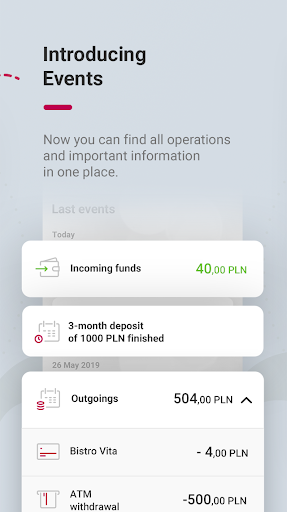

Pack the latest version of the app for your holidays:

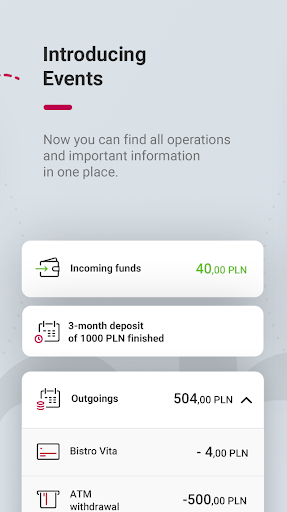

- it's shopping-ready – with one tap you can go to every transaction details from the Last events section

- you can check your transactions from accounts in other banks, add them through 360° Finance tile

- manage transaction limits completely on the go, according to your needs.

We've also added some fixes to improve app performance so that you can rely on it wherever you are.

In the latest version of the app you can apply:

- for Konto Mój Biznes account for business activity

- for a cash loan confirming your income more conveniently by logging into another bank (in selected loan processes and banks)

The new version of the app also contains bug fixes to improve the comfort of using the app.

Beyond ordinary banking

In the latest version of the mobile app you can have all your favorite services in one place. Now you will find loyalty cards, cinema tickets and public transport tickets in a new, separate section in the menu - Additional services. We have also updated the format of foreign transfers to better inform you about their costs.

This app version also includes minor bug fixes that will make your experience even better.

Check transaction details quicker

In the latest app version you can check any transaction directly from the Events section. Simply tap selected operation to get straight to transaction details.

This version includes also minor fixes and improvements to make your experience even better.

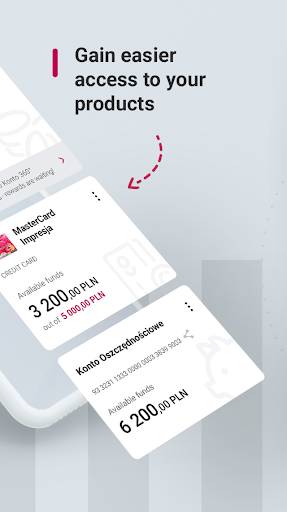

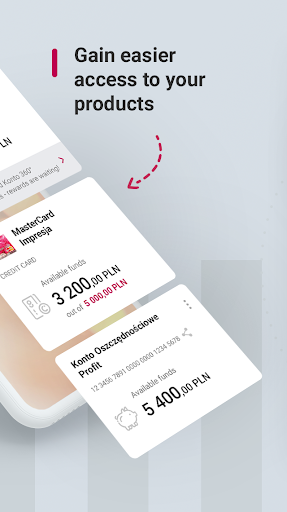

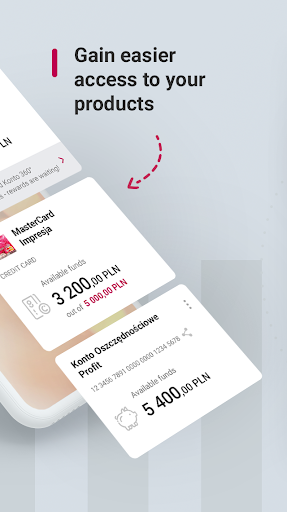

Decide what you want to see

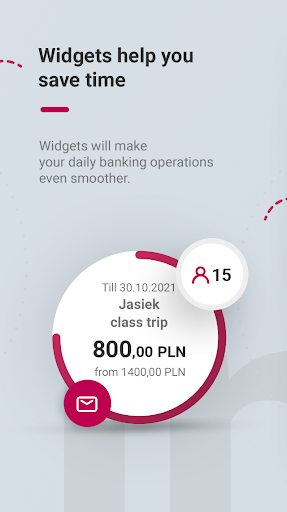

In the latest version of the mobile app you can decide what you want to see on the main screen in the My products section. From now on you can hide selected products on tiles and change their order at any time. The choice is yours! Changes made in the app will also be visible in Millenet.

This app version includes also bug fixes and numerous improvements that will make your experience even better.

In the newest app version:

- we have introduced the possibility of consolidating credit products from other banks and financial institutions

- we have improved the application activation process to make it even easier

- we have also improved BLIK payment process

This version also includes minor bug fixes and improvements

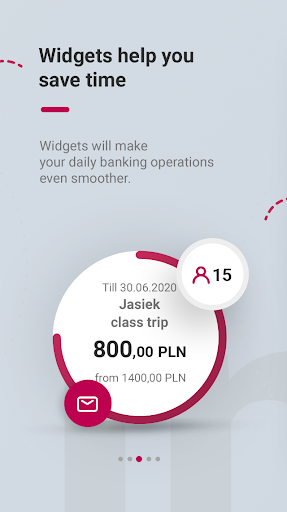

More convenience and freedom in the new version of the app!

This mobile app version includes numerous bug fixes and improvements to make your whole experience even more enjoyable.

More convenience and freedom in the new version of the app!

In the new version of the mobile app:

- choose which products will be displayed after login

- move them around, according to your needs

- use Autopay even more conveniently thanks to ride history and invoice download features

- Milla will inform you about your account balance and redirect you to selected processes

This version includes also many improvements.

In the latest app version you can use a temporary card block. This solution will always work when you are worried about your card security, e.g. when you leave it somewhere for a while (a wallet/bag in the locker room at the pool, gym or hairdresser) or you go to a concert. Then you can quickly and conveniently block the card in the mobile app and simply unlock whenever you need to.

The version also includes minor bug fixes and improvements.

Newest version includes minor improvements and fixes.

Newest version includes minor improvements and fixes.

In the latest app version you will conveniently confirm your spouse's application for cash loan.

This version also includes minor bug fixes and improvements.

In the newest version of the app:

•simply touch and press Bank Millennium mobile app icon in order to get instant access to shortcut menu with transfers, map of ATMs and branches as well as transaction history,

•business clients can now make split payment transfers,

•we have also redesigned, messages sent to you improving clarity and message structure.

This version includes also minor bug fixes and improvements.

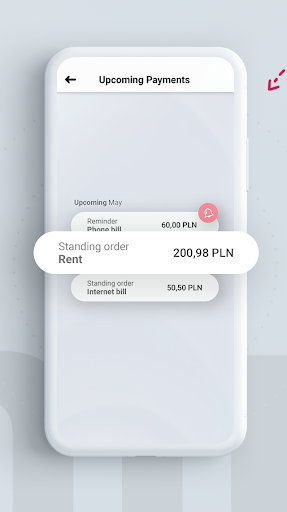

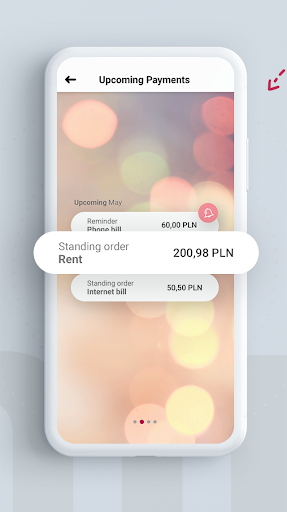

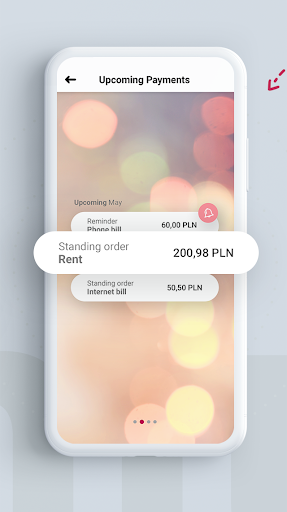

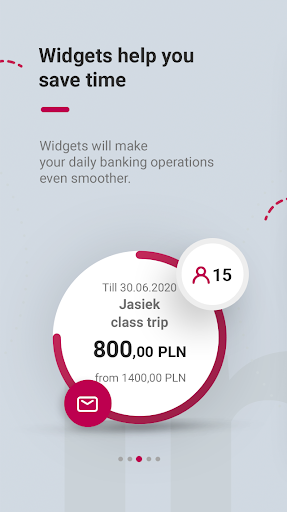

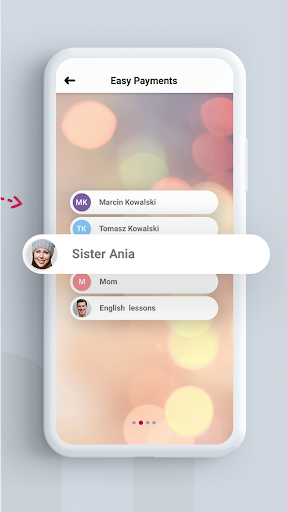

In the latest app version you can:

- set up a new order, edit or delete the existing one

- make a standing order or future date transfer earlier thanks to "Execute now" function on the list of upcoming payments

- make a transfer to account number or a BLIK transfer to mobile number using the domestic transfer form

- add "Like it? Share it!” widget, which will allow you to share the invitation code before logging in

This version includes improvements (also for Android P).

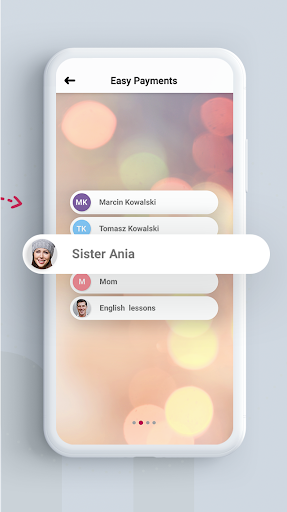

In the latest app version you will find:

- faster access to BLIK transfers to mobile: directly from the main screen, without accessing the the menu, or using widget available before login

- more intuitive and easier to use calendar, available in many app functionalities, including travel insurance

This version also includes other minor bug fixes and improvements.

In the latest app version you will:

• Join Bank Millennium via our mobile app. Download the newest version of the app and conveniently open Konto 360° or Konto 360° Student account – without the need to visit the branch, without the use of a computer.

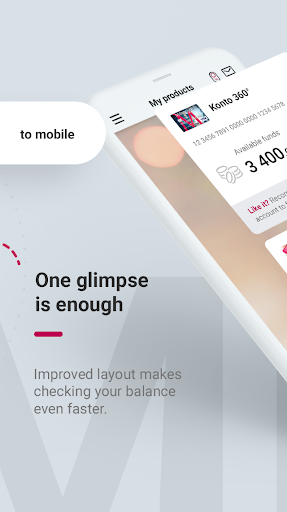

In the latest app version you will:

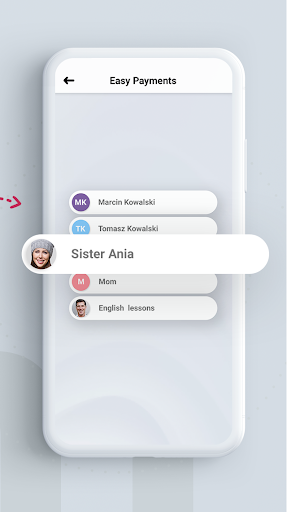

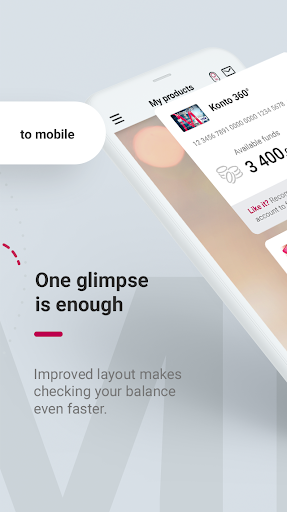

• easily check who uses BLIK transfers to mobile on your phone contact list

• find redesigned dashboard and even more convenient access to your products

• conveniently update your address and identity card details

This version also includes minor bug fixes and improvements.

What's new in version 4.24.250

With the latest app version you can:

• join the next edition of LIKE IT? SHARE IT! Programme, where you and your friends can get rewards for each recommend Konto 360° account

• apply for a new credit card (offer available to selected Clients)

This version also includes minor bug fixes and improvements.

What's new in version 4.23.145With the latest app version you can:• check details of your savings accounts so that you always know what is the interest rate on your funds and when the special offer is valid• quickly deposit cash in Bank Millennium deposit ATMs by using BLIK code (option available as of 28 February)This version also includes minor bug fixes and improvements.

In the latest app version:- you can open for free a foreign currency savings account in EUR and USD- you can renew your vehicle insurance policy (available to clients who had already purchased insurance with Bank Millennium)This version also includes minor bug fixes and improvements.

In the latest app version:- you can open for free a foreign currency savings account in EUR and USD- you can renew your vehicle insurance policy (available to clients who had already purchased insurance with Bank Millennium)This version also includes minor bug fixes and improvements.

In the newest version of the Bank Millennium mobile app:- you can in two steps open Profit savings account, just go to main menu and select Savings and investments > Savings accounts- as of 1 January 2018 you will be able use a simplified ZUS transfer form that allows you to pay all contributions with a single transferThis version also includes minor bug fixes and improvements.

The latest app version addresses the upcoming changes in paying contributions to the Polish Social Insurance Institution (ZUS). As of 1 January 2018, the ZUS transfer form in the app will be simplified:- you will be able to pay all contributions using a single transfer to your individual payer's account assigned by ZUS- you won't have to provide any additional identifiers, such as settlement period or NIP numberThis version also includes minor bug fixes and improvements.

The latest app version offers:Extended savings and investment section with intuitive, easy to understand overview of your savings and investment products, available in My Finance > Savings and Investments > My portfolio with detailed information on investment fundsThis version also includes minor bug fixes and improvements.

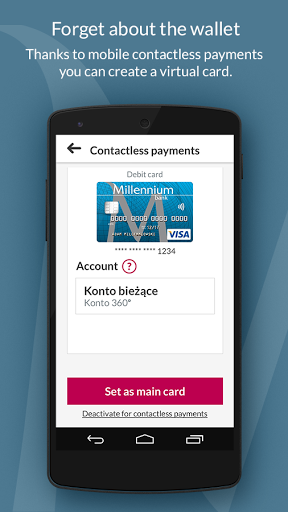

The latest version offers convenient:- travel insurance purchase (NEW!) with a widget that, if needed, will quickly locate you and alert your insurer- mobile contactless payment with any card – now you can turn any or your existing plastic cards into a virtual one in the mobile app.This version also includes minor bug fixes and improvements.

The latest version offers convenient:- travel insurance purchase (NEW!) with a widget that, if needed, will quickly locate you and alert your insurer- mobile contactless payment with any card – now you can turn any or your existing plastic cards into a virtual one in the mobile app.This version also includes minor bug fixes and improvements.

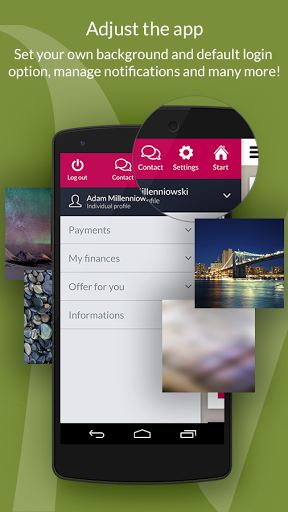

More convenient mobile bankingIn the latest version of our app, access to your account, mobile payments and other options has just become easier, thanks to:• new user-friendly menu – get quickly to your favourite functions,• transaction history with new options – add attachments and tags to search and order your transactions,• inbox in your app – click on the envelope and write to us whenever you need• direct call to the Bank consultant – you don’t have to log in to TeleMillennium system.

More convenient mobile bankingIn the latest version of our app, access to your account, mobile payments and other options has just become easier, thanks to:• new user-friendly menu – get quickly to your favourite functions,• transaction history with new options – add attachments and tags to search and order your transactions,• inbox in your app – click on the envelope and write to us whenever you need• direct call to the Bank consultant – you don’t have to log in to TeleMillennium system.

Huawei P20

Huawei P20